While voluntary carbon credit markets often take the limelight, this week we dive into the compliance carbon markets, which are 800x larger. This hidden behemoth has implications for corporations, carbon credit project developers, and traders. 👀

🎉 But first, here’s the best climate company and job we've heard of:

Climate Company: Envicore is not your average green cement company. They have tackled two mega climate challenges: cement (drives 8% of global carbon emissions) and hazardous mining waste (180 million tons dumped per year). How? They have developed novel supplementary cementitious materials from these hazardous mining waste streams that can be added to your standard Portland cement. Two birds with one stone.

Climate Job: Dioxycle is pioneering breakthrough carbon utilization technologies that convert industrial emissions into sustainable chemicals with unprecedented energy and cost efficiency, starting with ethylene, the world's most used petrochemical. The startup has raised $26M from top climate VCs such as Lowercarbon Capital, Breakthrough Energy Ventures, and Gigascale Capital. They are hiring for a Head of Strategy role.

Now on to compliance markets…

Voluntary (the carrot) versus compliance (the stick) carbon markets

Compliance markets deep dive ⚖️

Unlike voluntary carbon credit markets, where companies volunteer to reduce their emissions by buying credits, compliance carbon credit markets force companies to do so.

These compliance markets are run via a cap-and-trade system where a maximum level of allowable emissions is defined (the “cap”), and tradeable credits (“allowances”) are issued in line with the cap. Companies can choose to either reduce their own emissions or purchase allowances from other companies through compliance markets. If companies are above the cap and haven’t purchased allowances from other companies, they will be fined.

Cap-and-trade systems are being widely adopted to tackle carbon emissions, as they let governments set a maximum level of allowable emissions and ensure that predetermined reduction commitments are met. Similar policies have been successfully implemented to reduce emissions of other pollutants; a cap-and-trade system significantly reduced acid rain-causing sulfur emissions in the 1990s.

The devil is in the details with these markets. They may cover specific greenhouse gasses and sectors, allocate allowances differently (e.g., freely allocated versus auctioned off), price credits at their discretion, and vary in strictness.

Status of compliance markets around the world 🌐

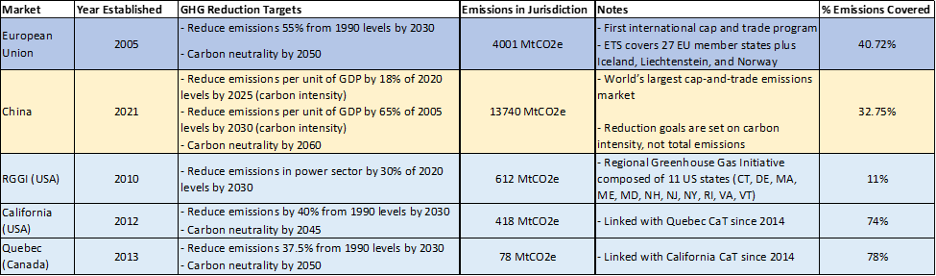

There are now 30 ‘compliance’ markets operating around the world. Together, these markets reached a value of more than $850 billion in 2021 and covered close to a fifth of global greenhouse gas emissions.

The two mega markets are happening in China and Europe. In 2022, China introduced the largest cap-and-trade zone in the world, after piloting various smaller carbon markets in its major cities. The Chinese ETS currently only regulates the power sector but is expected to expand to other industrial sectors in the future.

The European Union ETS, the first international cap-and-trade program launched in 2005, covers Europe and 75% of global carbon market futures and auctioned volumes. The EU ETS is the most mature cap and trade market and has been described as a “cornerstone instrument of the EU’s policy framework to combat climate change”. The EU ETS initially only covered power stations and heavy industry, and has gradually added aviation, and chemicals manufacturing emissions under the cap. Since its introduction, the EU’s emissions have decreased by 41% in the sectors covered. Since 2013, the EU ETS has generated 152 billion EUR in revenues.

The United States and Canada have been less enthusiastic about adopting national cap-and-trade systems, with patchwork agreements being pioneered by regional governments. In the US, 11 northeastern states grouped to form RGGI (Regional Greenhouse Gas Initiative), which focuses on reducing emissions in the power sector. California and Quebec have the most sophisticated cap-and-trade systems in North America, both of which cover over 70% of the emissions in their jurisdictions. The California and Quebec systems have been linked since 2014 as an integrated market. Cap-and-trade systems are expected to remain regional in the US as Congress continues to be gridlocked on climate issues. Mexico launched its national ETS in 2023.

As global carbon reduction efforts ramp up, it is expected for more countries to adopt cap-and-trade policies, and for existing systems to be integrated with neighboring markets, cover more economic sectors, and tighten total emission allowances.

Figure 6: Cap-and-trade systems around the world. Source: ICAP, World Bank

Trends to watch 👓

Article 6 from COP 28: As this gets implemented, countries will begin to trade carbon credits… with each other. Questions abound on how, when, where, and who regulates it.

Derivative trading in compliance carbon markets: Secondary trading can be executed on exchanges or in over-the-counter markets as spot, forward, futures, and options contracts. Mainly handled by larger financial institutions, there is room to democratize this trading, especially for regional-specific markets.

Voluntary carbon credit markets being traded in compliance markets: Some compliance carbon credit markets are allowing voluntary carbon credits to be used as allowances. Since many of these markets have implemented measures to protect the price of the allowance, this can be a less volatile option for project developers to sell into. For example, the Australian Carbon Credit Unit (ACCU) can be traded both on the compliance and voluntary carbon markets.

Inter-trading between voluntary carbon credits and compliance markets: As voluntary carbon credits can be sold into compliance markets, this opens up opportunities to buy low (negotiate the voluntary carbon credit price) and then sell high (with price transparency and safeguards in compliance markets). (Caveat: - this is pure speculation and forward thinking 😉)

EU’s Carbon Border Adjustment Mechanism (CBAM): The latest legislation passed in 2023 will help prevent carbon leakage by ensuring imports face a similar carbon price as domestic EU production under the EU ETS. The price of CBAM certificates that EU importers must purchase will be calculated based on the weekly average auction price of EU ETS allowances. As such, companies won’t be able to import cheaper alternatives to products developed under the EU ETS.

Your policy nerds,

Juan Pablo Quintero is pursuing a dual Masters of Environmental Management / MBA degrees at Duke University and is passionate about the intersection of climate and business. Originally from Bogota, Colombia, he grew up in the Northern Canada before moving to the United States for his undergraduate studies in New York. Outside of Duke, he has experience in climate activism and corporate sustainability through internships with the Sierra Club and McKinsey & Company, where he will return as an Associate in the Chicago office after graduating. He has published various pieces on the ocean economy and global climate policy. In his personal time, Juan Pablo plays bass guitar for the Duke MBA rock band and enjoys off-road desert racing.

Stella Liu is now part of the Third Derivative climate investing team after graduating from the Stanford GSB MBA program last June. She loves being early on technology and can now sound cool saying that she worked on AI in 2016 and carbon markets in 2019. At her core, she is a sustainability nerd. She grew up and is now based in California (can’t leave the good weather). In her personal time, she reads science fiction (Three Body Problem anyone?) and is growing a terrarium of succulents.