Industrial Heat Pumps: Hot or Not?

What do melting glass, driving chemical reactions, sterilizing food, and drying pulp for paper have in common? Heat.

Different temperatures of heat call for different climate solutions. In a prior piece, we outlined thermal energy storage solutions that can work at high temperatures (930+ °F). This week, we profile industrial-sized heat pumps that work in low and medium temperatures, representing ~42% of industrial thermal emissions.

The best part? They are cost competitive today (and sometimes cheaper!) on a levelized cost of heat delivery when compared to gas boilers.

In this issue, we explore why industrial heat pumps make sense now more than ever before, key challenges that are being overcome through innovation, a list of key players, startup profiles, and bull/bear perspectives on the future of this technology.

Gigaton potential

Worldwide, heat makes up roughly three quarters of energy demand for industry and accounts for more than one-fifth of total global energy consumption. Most industrial heat production comes from the combustion of fossil fuels: 45% is produced using coal, 30% with natural gas, 15% with oil, and only 9% with renewable energy. This amounts to roughly 12 gigatons of GHG emissions per year. The biggest CO2 emitters in this sector include cement, steel, petrochemical, glass, ceramics, and refining industries.

For reference: in 2019, the world emitted 51 gigatons of CO2-equivalent greenhouse gases. Project Drawdown estimates we need to cumulatively eliminate 1,000 GT from 2020-2050 to keep global warming below 2 degrees Celsius.

What you should know

Why are industrial heat pumps so efficient?

Heat pumps are more efficient because they move heat rather than create it. Heat pumps are two to three times as efficient than gas boilers - for one unit of electricity, a heat pump can generate up to two or three units of heat. For gas boilers, one unit of electricity only generates 0.83 units of heat.

Heat pumps accomplish this by using a small amount of electric energy to absorb energy from their surroundings (air, water, or ground) into a hyper efficient fluid called a “refrigerant” which absorbs and releases heat. When the refrigerant heats up, it turns into a gas. The pump compresses the gas which causes the refrigerant to heat even more, and then the gas is emitted from the heat pump as heat. Through this process, the refrigerant condenses and expands, which releases even more heat.

Why now?

Heat pump technology has been around since the 1930’s. However, industrial heat pumps currently supply only ~5% of global industrial heat.

Here’s why this is starting to change:

Volatile gas prices and declining electricity prices are making the ROI for heat pumps stronger

Heat pump adoption is correlated with electricity and gas prices. When gas becomes more expensive, heat pump adoption soars. During the recent EU crisis when natural gas spiked, heat pump adoption went up by 35%. When gas prices went down in the 80s and 90s, heat pump adoption stalled because gas boilers were cheaper. Experts are projecting that natural gas prices will remain stable or increase to 2040 due to demand-supply gaps while electricity prices are estimated to decrease. Thus, over the long term, the economics of heat pumps are promising when compared to gas boilers.

Advances in heat pump technologies

Higher temperature heat pumps: Most industrial heat pumps are being used in low temperatures today <212°F in industries such as textiles and food and beverage. The next frontier is working with higher temperatures 212°F to 392°F which unlocks process heat that uses steam (~50% of industrial processes). R&D and early piloting is in progress here with startups.

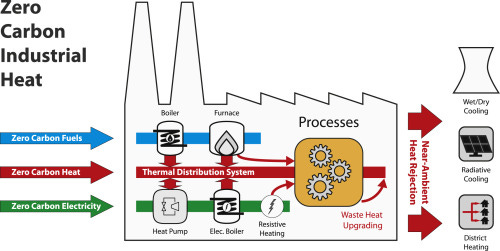

Integration with other emerging technologies: Industrial heat pumps can also be used with other emerging technologies such as thermal heat storage or electric boilers which drives down carbon emissions and costs even further.

Efficient heat exchange: Improved heat exchangers now move heat more efficiently.

Regulatory tailwinds exist now

The Biden Administration slotted $6B in investments to decarbonize the industrial sector. Industrial heat pump manufacturers can use the $10B 48C clean energy manufacturing tax credit which can drive down manufacturing costs. The IRA appropriated $500M to the Defense Production Act that can fund domestic heat pump manufacturing. The IRA also enabled catalytic financing mechanisms to lower the financed cost of heat pumps from manufacturing to deployment: $3.6 billion from the DOE’s Loan Programs Office and $27 billion from the Greenhouse Gas Reduction Fund. Both can leverage private capital at up to a 10:1 ratio.

Challenges that are being overcome

Even though the timing makes sense now more than ever, challenges remain before full deployment. Startups have been full steam ahead:

Challenge #1: Selling to paper and pulp, textile, and chemical manufacturers that run thin margin businesses is not easy. These folks want to see a 1-3 year payback period, and balk at the idea of paying hundreds of thousands of dollars upfront for an industrial heat pump. While heat pumps are 2-3x more efficient, the benefits are realized over a longer period of time.

Business model innovation: Rather than having factory owners pay up front, startups are shifting to an “energy as a service” model. The pitch? Zero down in exchange for signing a long offtake agreement to pay for the heat or steam used at a price that’s cheaper than what the factory is paying for natural gas. Once the track record of generating positive cash flow and short payback periods is established, these projects can then be financed through loans. Skyven technologies makes the entire process turnkey (procurement, installation, commissioning, and maintenance) and at their own cost. In exchange, the plant owner only pays for the energy used and saves operational expenses from using gas boilers which can be up to $800K in savings a year.

Challenge #2: Factory owners want to avoid downtime as much as possible. The more they produce, the more they earn. Installing a large industrial heat pump system can be complex, and can take specialized labor and time to set up.

Design innovation: Startups are focused on designing their industrial heat pump to be as modular and “drop in” as possible. AtmosZero can pipe their heat pump system into existing infrastructure and the system can be installed on site or nearby, reducing the install time significantly.

Challenge #3: Natural gas prices can be very cheap in some areas, and it is difficult to make industrial pumps cost-competitive in those areas.

Tech innovation: Between 20% and 50% of industrial energy input is wasted in the form of hot exhaust gasses, cooling water, and heat lost from hot equipment surfaces and heated products. Using waste heat as part of the solution improves the economics even further. A variety of technologies including the Organic Rankine Cycle (ORC), Steam Rankine Cycle (SRC), Supercritical CO2 systems, and others can capture heat and turn it into electricity. Kanin Energy, a turnkey project developer, matches the factory with the right “waste heat to power” technology and installs industrial heat pumps as well. Being able to upcycle low or ultra-low heat is still frontier with whitespace available; There are larger players like Echogen who can handle temperatures above 392°F.

Many of the emerging industrial decarbonization technologies can drive down carbon emissions and costs in tandem:

Key Players

Large incumbent companies such as Siemens, Johnson Controls, and Mitsubishi already sell industrial heat pumps. Johnson Controls recently acquired Hybrid Energy in 2023 to expand its industrial heat pump portfolio.

However, most of these incumbent industrial heat pump technologies can only support up to 302°F. There is whitespace to support higher temperatures than that. Skyven Technologies is pushing the heat frontier to 420°F. AtmosZero is pushing to 392°F while generating steam in the process. These new temperatures open up new markets that the incumbents aren’t in.

Startup Profiles

Founded in 2021, AtmosZero developed a product called the Boiler 2.0, a modular electrified boiler that extracts heat from the air to generate decarbonized steam, delivers high-temperature steam (392°F+), and is a drop-in replacement for existing natural gas and oil boilers. They raised a $21M Series A in Feb 2024 from Engine Ventures and 2150 with participation from Constellation Technology Ventures, Energy Impact Partners, Starlight Ventures, and AENU. AtmosZero was awarded a $3.2 million grant from the U.S. Department of Energy's Industrial Efficiency and Decarbonization Office (IEDO). In October 2023, AtmosZero launched its European subsidiary, AtmosZero Europe, B.V., based in Amsterdam, Netherlands.

Founded in 2013, Skyven Technologies developed a line of steam generating heat pumps that also does waste heat recovery. Their “energy as a service” model helps customers adopt their technology without having to pay a hefty up front expense. Savings are shared between the manufacturer, third-party financers, and Skyven for the life of the contract. In January 2022, the company closed a $4 million seed round led by VoLo Earth Ventures. This funding, combined with California Energy Commission grant awards, brought their total capital intake in 2021 to $6.5 million. In March 2024, Skyven was selected for a $145 million investment from the U.S. Department of Energy's Office of Clean Energy Demonstrations (OCED).

Bear/Bull Perspectives

Bull POV: Why things can go right

Large market size: There is an estimated total CapEx of $300 billion just to replace existing boiler capacity with industrial grade heat pumps.

New frontier, whitespace for innovative startups: Startups can push up the heat frontier and establish their market share before incumbents rush in.

The ROI pencils out meaningfully: Natural gas prices continue to be volatile and rise over time; electricity prices continue to decline.

Main components can be sourced off the shelf with limited scale up risk: Because the core heat pump technology is not novel, startups can use existing supply chains to scale up their products.

Interest rates go down: Financing the “energy as a service” model becomes even more cost effective when partnering with third party financiers.

Sticky customers: The heating process for a factory is usually mission critical. Once these electric heat pump-driven boilers are installed, it’s hard to rip and replace for a new startup competitor. Startups can enjoy a moat if they are the first to enter.

Bear POV: Why things can go wrong

Deployments end up being bespoke and highly custom: Despite all the best intentions for their technologies to be dropped in, startups discover that they need to customize their solution depending on the temperature, customer workflows, and sector. Deploying custom solutions makes it difficult for startups to take off in a hockey-shaped growth curve.

The long tail of small and mid-sized plants halts growth: While automotive and aerospace manufacturers are large, most of the other manufacturing sectors (cement, concrete, paper and pulp, etc) are run by small or medium-sized shops. Going after SMBs can be an expensive marketing/sales process and may prevent startups from getting to full scale or the industrial sector from getting to net zero.

Investors are scared about the capex intensity of the business: While the “energy as a service” model can drive adoption, startups end up owning the capex with potentially long payback periods, scaring away traditional VC investors. On the flip side, project finance investors may be attracted to the slow growth, but stable cash flows. However, getting to the stage of maturity for that capital will require more risky forms of capital from venture capitalists - few are comfortable with capex-intensive businesses.

Startups lack a tech moat: The core technology for heat pumps has been around for decades and building defensibility around the technology is difficult.

Natural gas prices decline: The decline in prices squeezes margins for the “energy as a service” model as startups battle to provide a service cheaper than natural gas.

The need for specialized labor slows growth: These industrial heat pumps may require specialized HVAC technician skill sets to install (unless they are truly drop in). There’s already an HVAC technician shortage happening, which can slow installation rates.