Gigaton Potential

Eating more veggies (and fewer animal products) is more than a wellness trend - it’s also one of our most powerful tools for mitigating climate change. Project Drawdown estimates that a large-scale shift towards plant-rich diets could reduce carbon output by ~65-92 gigatons cumulatively by 2050.

For reference: in 2019, the world emitted 51 gigatons of CO2-equivalent greenhouse gasses. Project Drawdown estimates we need to cumulatively eliminate 1,000 GT from 2020-2050 to keep global warming below 2 degrees Celsius.

You Might Be Interested If...

You’re a veggie lover or foodie

You’re interested in demand-side solutions to climate change and believe consumer voices are powerful change drivers

You want to tackle climate change from a consumer-products perspective

Animals hold a special place in your heart

What You Should Know

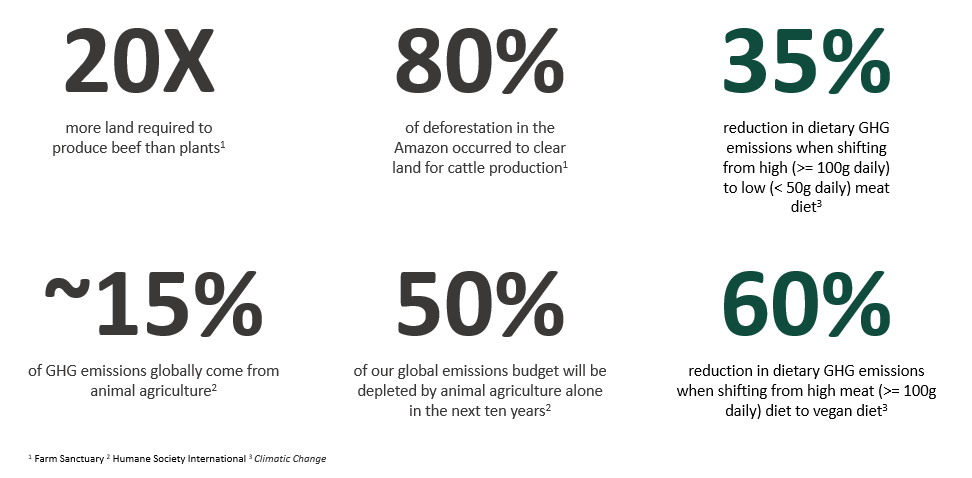

Factory farming is one of the largest environmental risks facing our world. The farming process is one of the leading contributors of GHGs. Humane Society International estimates it directly accounts for ~15% of emissions globally; if the animal agriculture sector grows as expected, it will deplete nearly 50% of the world’s emissions budget (to limit global warming to 1.5 degrees Celsius, as defined by The Paris Agreement) by 2030.

But there are also indirect impacts. With 88B+ animals raised for food each year (excluding marine animals like fish!), factory farms also contribute to deforestation, biodiversity loss, water contamination, and freshwater depletion.

While this may sound bleak, the good news is that there’s a relatively simple yet high potential solution that most individuals can take part in: reduce consumption of animal products.

Project Drawdown defines a plant-rich diet loosely. Food consumption is highly personal - and defined by many constraints including budget, health, and culture. This solution doesn’t require becoming completely vegan or vegetarian, but rather limiting meat-based protein consumption and purchasing local food when possible. Even small steps count - a single day of eating vegetarian can save up to ~8 pounds of CO2.

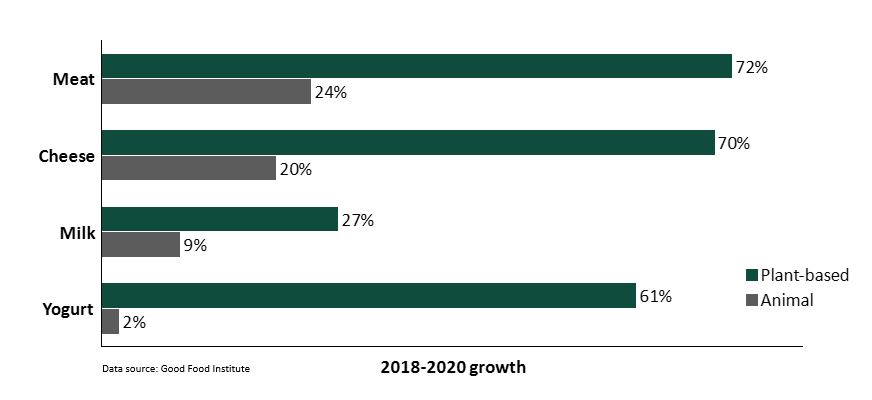

And in more good news, there’s a large and growing market for plant-based foods (defined as those that replace animal products). The global market was valued at ~$30B in 2020, and the US market at $7.4B in 2021, a YoY growth rate of 6% from 2020 and a 3-year growth rate of 54%.

And these plant-based products are gaining on their equivalent animal products, growing faster across nearly all categories. See below for historical trends (data from the Good Food Institute):

Another bullish indicator is the rapid growth of investment in companies focused on substitutes to animal-products, at ~$5B in 2021, a 60% increase from the prior year.

Key Players

The plant-based food market is large and fragmented, with players ranging from innovative start-ups (e.g., Nobell Foods) to established brands (e.g., Impossible Foods, Beyond Meat, Oatly) to conglomerate-owned brands (e.g., MorningStar, Sweet Earth, Silk). We’ve segmented the market into major product lines:

Meat substitutes: Impossible Foods and Beyond Meat have paved the way for plant-based products that most closely mimic meat; both are large companies with lots of runway for future growth. Also included here are meat-alternative brands like Sweet Earth and MorningStar that are owned by larger conglomerate companies, as well as smaller disruptors like Good Catch (owned by Gathered Foods), which has started a plant-based seafood line.

Cultivated substitutes: Also keep your eye on the nascent cultivated meat / dairy industry, with players like UPSIDE Foods, Future Meat, Blue Nalu, Perfect Day, and Brave Robot pioneering lab-grown meat and dairy products. Cultivated meats are not yet approved in the US, and federal regulations are still under development (particularly around labeling), but companies are hopeful that FDA and USDA approvals are soon to come on a case-by-case basis.

Dairy substitutes: This market is owned largely by milk substitutes (e.g., Oatly's oat milk, Silk’s almond milk) but also includes plant-based cheese, ice cream, and butter products.

Other: Brands that are starting to innovate on other traditionally animal-based products like eggs and whey protein powders, often using processes such as fermentation.

Policy & advocacy organizations: Interested in tackling climate change from a policy perspective? Organizations like the Good Food Institute, the Plant Based Foods Association, and Food Solutions Action are helping to pave the regulatory groundwork for alternative proteins and to increase public funding for R&D. The Humane Society and other animal-welfare organizations advocate for both plant-based alternatives and higher standards for factory farming.

See here for a much more comprehensive market map.

Opportunities for Innovation

🌿 Costs

Despite the massive growth in the plant-based alternatives market, prices are often higher (~38%) than the animal-equivalent products, largely due to the smaller scale of production. Equal pricing is a goal for many of these plant-based brands, but work remains to get there.

🌿 Consumer preferences

Diet is highly personal and food habits and traditions are hard to change. Penetration of plant-based alternatives will always be limited by consumer openness to diet changes.

🌿 Product innovation

Many plant-based alternatives haven’t quite equaled their animal counterparts on some taste / texture metrics - for example, it’s proven especially challenging to get plant-based cheeses that will melt and stretch. Luckily, lots of companies are working on it.

🥳 What did you think? Let us know here.

Sources

https://link.springer.com/article/10.1007/s10584-014-1169-1#citeas

https://gfi.org/marketresearch/#comparison-to-animal-based-foods

https://www.vox.com/22456572/plant-based-vegan-cheese-motif-perfect-day

https://www.cnbc.com/2021/08/25/impossible-foods-beyond-meat-battle-price-parity-with-real-meat.html