Introduction to Climate Insiders ⭐

In my last article, I described the tough job market - a perfect storm of layoffs and slow hiring that is making it harder than ever to secure a role. In climate technology, this challenge is especially acute for business/non-technical professionals.

What to do? Fish where no one is fishing. Once a job role is publicized across well-known job boards such as Climatebase, CTVC, or Terra.do or a startup raises from a VC fund like Sequoia, you’re competing against thousands of hopeful applicants.

I am excited to announce a new paid subscriber experience on the Gigaton called “Climate Insiders,” where you’ll find non-obvious opportunities. I’ll draw insights from my networks in climate VC and Stanford which you can’t find anywhere else.

I’ll profile the climate startups you likely never heard of that are growing rapidly. You can reach out to them before other people do - maybe even create a new role for yourself. You’ll get in-depth, tactical interviews from other folks who secured top business roles (climate VC, chief of staff, etc) in climate technology during this difficult job market. I’ll post climate roles that aren’t posted on job boards, so you have a leg up in applying. In every climate deep dive, you’ll receive a list of promising startups working on the solution. Stay tuned for updates on the community which will focus more on creating connections.

Climate Insiders Preview

Rocketship climate startup profiles 🚀

Nira Energy is a Y Combinator startup addressing interconnection issues on the grid. Renewable energy developers have one final step to deploy their clean energy - interconnecting to the grid which is completely backed up. Projects waiting for the green light to begin construction added up to more than the grid’s entire existing capacity at the end of 2021. Over 50 clean-energy developers and other customers have used Nira Energy’s software to process over 300 gigawatts’ worth of clean-energy interconnection requests.

Joule Case is a rapidly growing startup that launched a patented portable, modular, and clean battery system. This product is meant to displace harmful diesel generators that produce noise and air pollution, including nitrogen oxide emissions that contribute to ozone depletion. They are going after EV charging, entertainment, residential, and commercial markets, and have enjoyed great traction. The two co-founders have spent over a decade working in modular power.

TS Conductor has innovated a novel conductor for the energy grid that can cut line losses in half, which can save the U.S. economy billions of dollars by preserving electricity that never reaches its destination. During peak periods, the conductor can handle triple the capacity with the same overhead line towers. The CEO was the former CEO of CTC Global, a leading conductor company in the US which he turned out of bankruptcy. A rare combination of breakthrough technology, a huge value proposition, and an incredible leadership team.

Climate jobs not posted on job boards 🔥

Active Surfaces is an early-stage MIT spin-out commercializing an ultra thin-film solar technology based on decades of MIT research. Their technology has the potential to unlock terawatts of next-generation solar deployment - redefining what could be solar. (MIT 100K Winner, Forbes 30/30 Founder, Greentown Labs Company). They are hiring a Director of Business Development - application is here. Ignore the deadline, they are still hiring :)

itselectric is a Brooklyn-based startup with a mission to unlock access to electric transportation in cities across the US. They are hiring a Head of Partnerships role to report to the COO.

Netflix is expanding its corporate sustainability team here.

Edgecom Energy’s IoT and energy monitoring solution for industrial sectors is considering expanding its business development team.

Ananda Impact Ventures with a focus on climate technology in Munich, Germany is hiring a new VC associate.

Exclusive interviews

Remember the story of Florian, who landed a Chief of Staff role at a heat pump company without turning in his resume? Stay tuned for an interview with him in our next issue, where you’ll learn how to knock months off your recruiting journey.

The Gigaton has been a free resource for two years…! It was a labor of love during graduate school, but paid subscribers will allow me to keep publishing over the long term.

From now on, Climate Insiders will receive bi-weekly content - anything that can’t be readily Googled will be part of the paid experience. Free subscribers will still receive a monthly climate solution deep dive (but no job postings, high-growth startup profiles, full interviews, etc).

Gigaton potential

Did you know that cement is the second most used substance in the world after water? It’s also a significant source of greenhouse gas emissions. According to Project Drawdown, substituting industrial waste products for conventional inputs can reduce the carbon footprint of cement by 7.70 to 15.56 gigatons between 2020 and 2050.

For reference: In 2019, the world emitted 51 gigatons of CO2-equivalent greenhouse gases. Project Drawdown estimates we need to cumulatively eliminate 1,000 GT from 2020-2050 to keep global warming below 2 degrees Celsius

What you should know 🤓

Global cement production is a massive global market, but it hasn’t grown for over a decade. The total tons produced per year has been around four billion tons since 2012, a whopping ~$360B market size.

Specific market segment growth is driven by emerging countries that need to pour cement to build new infrastructure. China has been the leading global cement producer, representing half of global production. In contrast, in 2022, total U.S. spending on cement was ~$14.6B. In the future, as China’s growth and infrastructure build out slows down, cement production in China is expected to decline. This is expected to be offset by cement demand in Southeast Asia, Latin America, and Africa to meet their development needs. Thus, new green cement startups in the United States have a decent near-term market opportunity locally, but will need to consider expanding internationally in the future to unlock the total addressable market.

Cement is a highly consolidated, complex, and regulated market that is not for the faint of heart. The cement value chain is consolidated at either end, but deeply fragmented in the intermediate tiers. (see below) On the supply side in the U.S., the top companies account for over 80% of installed production capacity while on the demand side, government procurement drives ~50% of US cement consumption. Most cement produced goes through thousands of intermediaries (e.g., ready-mix concrete companies, concrete product manufacturers, contractors, and materials dealers) before being poured on a customer’s site.

Source: Department of Energy

State, federal, and national governments are promoting the demand for green cement by setting up procurement programs. The General Services Administration (GSA) recently announced a 6-month pilot program that will apply interim global warming potential limits for construction materials like cement and concrete in 11 ongoing publicly funded projects. This pilot will help develop GSA's final standard for low-embodied carbon requirements in IRA-funded projects. California has implemented a "Buy Clean" program that sets maximum global warming potential limits for cement, concrete, steel, and other construction materials used in public projects. The United Nations Industrial Development Organization (UNIDO) is leading a Green Public Procurement campaign that has engaged seven key governments to generate demand for low-emission cement and steel technologies.

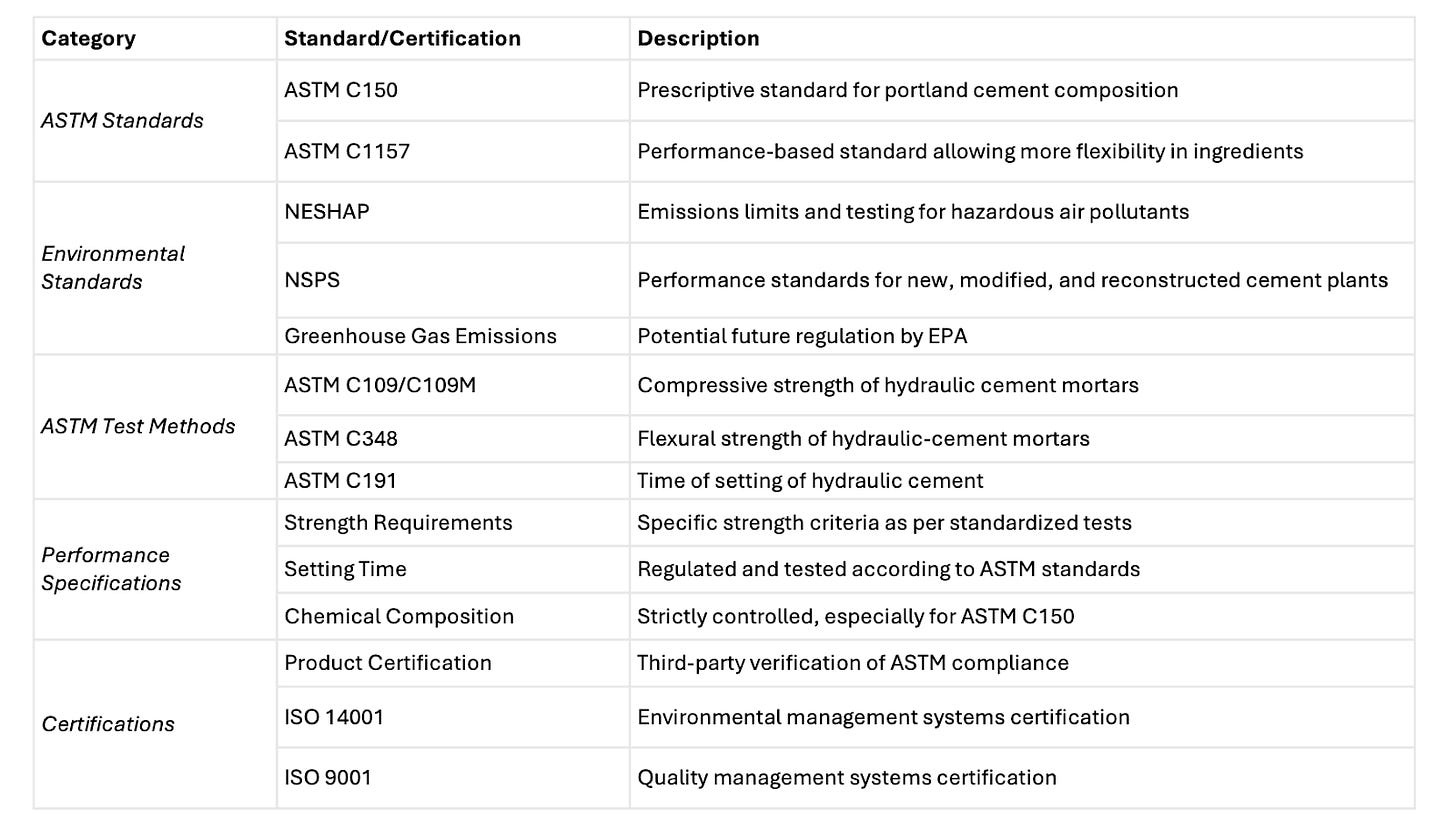

Regulations abound to ensure the performance, safety, and quality of cement, specifically a kind of cement called Portland cement that is widely used in construction.

Innovation landscape

Gosh, they call cement “hard to abate” for a reason! Startups thankfully, have not given up. They are taking an 80/20 approach to decarbonizing cement. It’s all about the clinker, a mix of limestone and minerals heated up to make cement in the kiln. Clinker accounts for approximately ~90% of the emissions released in cement production:

Source: McKinsey

Here are the hottest innovation areas to address this challenge:

New cement producers:

Waste to value: Taking waste that no one wants (or even better, that someone would pay to get rid of) and partially replacing cement (called “Supplementary Cementitious Materials” or “SCMs”). Experts say that 30-40% of clinker can be substituted with waste products without compromising performance. Traditional SCMs (such as fly ash from coal plants and blast-furnace slag from iron ore melting) account for only 15% of current cement production with the scope to increase to 30-50%.

Alternative cement composition: replacing the limestone with less carbon-intensive materials like calcium silicate rock.

Carbon capture meets cement: developing synthetic limestone using captured CO2 that can be used in cement.

Enabling technology:

IoT & AI optimization of production: using sensors and AI to optimize the clinker process so you can reduce the energy required and emit less emissions.

Electrified or minimal heating: indirectly heating minerals, novel chemical processes that require no heat at all, or creating a kiln fired up with renewable energy instead of fossil fuels.

Smaller, modular cement plants: cement plants that ramp up or down at smaller scales, resulting in lower energy input and carbon emissions.

Pssst - Climate Insiders get to see examples of VC-backed startups in each innovation area. 🎉

Smart questions to ask

For new cement producers:

The regulatory hurdle is high. What kind of certification and standard testing has been done to date?

There can be long term supply constraints with using waste as inputs. For example, fly ash comes from coal plants which will be phased out over the long term. There is also increased competition for biomass. How are you thinking through your procurement strategy? Can your solution use different types of waste streams?

You’re competing with players who enjoy massive economies of scale in a cost-sensitive industry. What price point are you selling the product at a small scale? How does this change with higher volumes?

Setting up your factories requires a lot of cash. How are you thinking through your capital stack in this tough fundraising environment?

For enabling technology:

The value chain has entrenched players on both ends with thousands of intermediaries. What experience does the leadership team have in breaking into traditional industries? How are you thinking about your go-to-market strategy?

A handful of cement producers control the market. How are you thinking about managing such a highly concentrated customer base? Can your technology be used for other industrial sectors too? What are the proof points of that?

These producers have been running things their way for years. How drop in is your technology into existing processes?

What’s most exciting

Waste to value startups using novel waste streams that are unlocked by a proprietary chemical process and partially replace cement without a green premium (and enjoy superior unit economics than traditional cement)

Heating technology that’s minimal heat or powered by renewables that can be used by multiple industries (aka a platform technology) and dropped in into existing factories

My favorite reads

The Department of Energy cement liftoff report