It’s about time we talked about critical minerals. The Department of Energy and IEA have sounded alarm bells about a potential demand-supply gap. Tesla and other EV OEMs have been signing offtake agreements to secure these minerals. The Mining Tech sector received $2.68B in VC funding in the last 10 years. Funding peaked in 2024 (amid a very slow fundraising environment) at $725M.

In this article, we go beyond the headlines:

Which critical minerals should we pay attention to the most and why?

Is the gap as big as the experts are saying?

What would dramatically change these forecasts?

What are the challenges that startups will need to overcome to be successful?

Our journey into this space touches on international politics (including a story on how the Chinese cornered the global nickel market), the drivers behind price volatility, and the trillions of dollars of untapped minerals in mining waste.

You can count on us for an impartial view on both the challenges and opportunities, and for us to take you from 0 to 100 on these hot topics with the best sources.

Critical Minerals 101

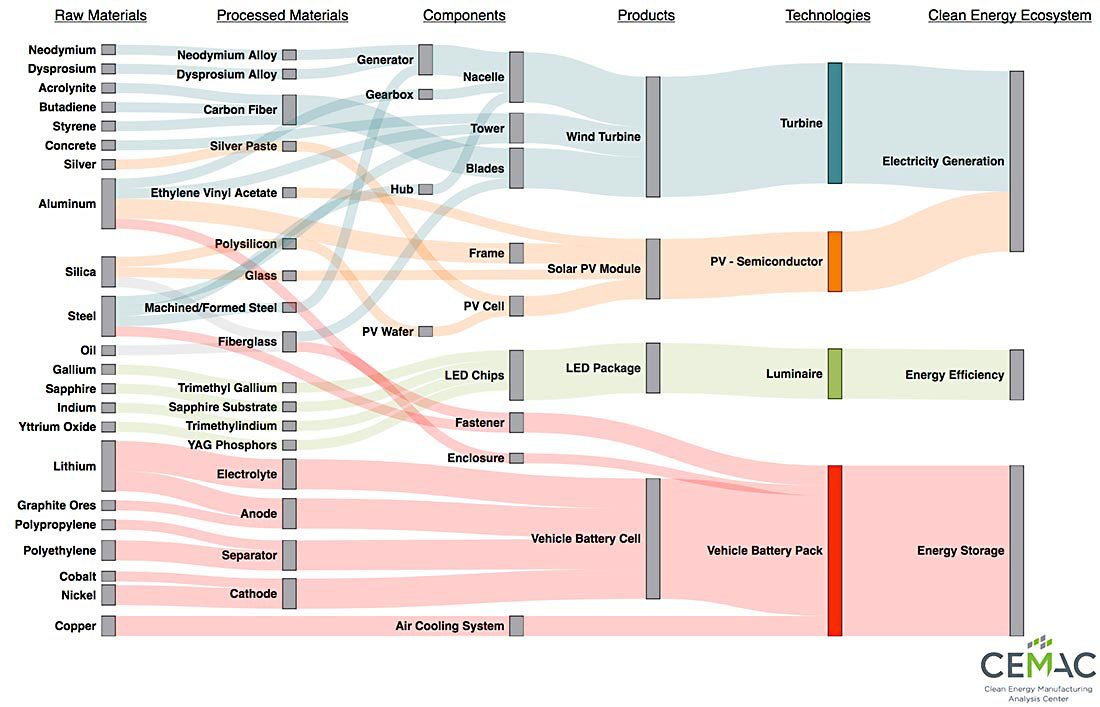

The demand for critical minerals is linked to the energy transition

While climate technologies are cleaner than their fossil fuel counterparts, they consume more minerals. An electric car uses six times the mineral inputs of a conventional car and an onshore wind plant requires nine times more mineral resources than a gas-fired plant. Since 2010, the average amount of minerals needed for a new unit of power generation capacity has increased by 50% as renewable energy adoption has risen. (IEA 2021) Later in 2015, EVs and battery storage surpassed consumer electronics to become the largest consumers of lithium, accounting for 30% of total current demand. Last year, the total market size for metals and mining was $325B, and IEA estimates that by 2040, this size can double if countries follow their stated policies.

Source: NREL 2020

Why supply can’t keep up with demand

Building and operating a new mine can take decades due to longer exploration, permitting, and financing despite shorter construction times. The average lead time from discovery to production for new mines is about two decades.

Over half of the extraction and processing is happening in China and developing countries, adding fuel to an already tense geopolitical scene. For some minerals such as rare earth minerals, manganese, and natural graphite, China processes over 80% of the world’s supply. The production of these critical minerals today is more geographically concentrated than oil and gas.

The invisible hand, monopolistic players, and international politics create a volatile market for minerals

The price of minerals is highly sensitive to changes in demand and supply. Lithium prices skyrocketed in 2021/2022 in response to breakthrough growth in EVs, but when miners rushed to the scene with new supplies of lithium, the price dropped by 80% two years later. In this tantalum example, the price spiked in 1980, which drove miners to build more mines. When the mines started producing tantalum, there was an oversupply that led to prices dropping by 80%+.

Volatility drivers on the metal market 2019

Monopolistic players behind the scenes can pull strings that move markets. For lithium and germanium, the top five producers supply 70%+ of global demand. Their actions in opening or closing mines have a large impact on the market. In late 2023, Albemarle, a major lithium producer, announced plans to reduce its lithium production and delay expansion projects due to an oversupply of lithium in the market. Other producers have followed suit, and the price of lithium stabilized.

Technological change and international politics have disrupted pricing in the mineral market. The interplay of the two led to the rise and fall of saltpeter, a feedstock for fertilizers and explosives. After the War of the Pacific, Chile became the sole owner of the world’s only known deposits of saltpeter, leading to an unprecedented rise in wealth in the country. As industrialized nations became dependent on Chile, they rushed to find an alternative that led to a breakthrough discovery of synthetic ammonia. Demand for saltpeter declined, and Britain later imposed a saltpeter embargo. Saltpeter prices collapsed and never recovered again. Chile amassed international debt and defaulted in 1931. We may see a similar story repeat as countries consolidate their control over minerals that are fundamental to the energy transition and other countries attempt to reduce their dependency.

Lithium and Copper are the minerals to watch.. for now

With such a volatile market, it is difficult to anticipate where the market will be across long timescales. But in the near term, the picture is clearer - and more nuanced. McKinsey’s 2024 Minerals Outlook, IEA, and the Department of Energy’s Critical Materials 2023 report converge on lithium as the mineral that is most at risk in the medium term when accounting for demand and supply factors. Almost all EVs and stationary energy storage rely on the lithium-ion battery chemistry because it has the highest energy density and longest lifespan at the cheapest price when compared to all other battery chemistries. Based on the production of existing and planned mines, lithium supply is expected to be stagnant through 2030. The demand-supply gap is the greatest if the world is on track to meet its sustainable development goals.

Copper is also expected to have a shortage crunch. Chile, the world’s biggest producer of copper, has been experiencing a decrease in the average copper ore grade by 30% over the last 15 years. At the same time, auto OEMs are announcing a shift away from rare earth elements for ~40% of cars sold by brand, which increases the demand for copper as a substitute. Copper prices have been overall increasing for the past couple of decades. A director at the federal government told us, “There is a copper supply demand gap and the copper price will increase. Some processing companies do not have ores to process for two weeks.”

Source: IEA 2024

Graphite, nickel, and cobalt are hot topics because of geopolitical risks. China represents 74% of the total supply chain for graphite anodes with limited near term substitution options. The majority of nickel extraction happens in Indonesia (mainly controlled by Chinese investors - more on that below), which then gets processed in China. Most of the mining for cobalt happens in the Democratic Republic of the Congo. “Cobalt Red,” a Pulitzer Prize finalist book, states that most of the DRC's cobalt is extracted by "artisanal" miners — freelance workers who do dangerous labor for the equivalent of a few dollars a day. While the experts we spoke with did not see near-term demand and supply shortages for these critical minerals, this can change on a dime. War, embargos, tariffs, and more can disrupt supply.

What would dramatically change these forecasts?

Supply side:

#1 A technology breakthrough in mining critical minerals

The mining sector is ripe for disruption. "Mining is probably the least innovative industry and is very risk averse because one little glitch in the supply chain could have huge implications. It is very hard for the mining industry to embrace any changes due to the high risks. I have not seen many examples of a tech completely transforming an end-to-end process. There are a lot of small incremental improvements, but not much tech that is transformative,” an investor at a VC fund told us. Startups are disrupting the mining sector by developing technologies that can extract minerals in sites that have previously been uneconomical to access.

A study by CRU Group estimated that there’s a decade supply of copper in mining waste - called tailings - worth $2.4 trillion dollars at today’s market prices. As the price of copper increases, it is becoming more economical to mine for copper in tailings. Challenges abound. The low concentration of copper requires processing through large amounts of waste before recovering the copper. Copper materials are often very finely disseminated, requiring additional grinding to liberate them. Tailings can also contain a variety of minerals, making selective recovery of copper more difficult. However, if a breakthrough technology can overcome these challenges, the size of the prize is substantial. Sunchem’s proprietary chemical platform is a cost-effective, bolt-on system to filter out heavy metals from industrial waste streams - starting with gold and copper from mining tailings.

Startups are also developing technologies that can extract lithium in sites that haven’t been able to be accessed before (ex. Lilac Solutions), finding more productive sites with the use of satellite imagery and AI (ex. KoBold Metals), and turning to the ocean in search for more critical minerals (ex. Impossible Metals).

#2 China continues to become vertically integrated across the critical mineral value chain

In 2014, Indonesia decided to pass an export ban on nickel, which made large Chinese-invested industrial parks become the largest buyers of Indonesia’s nickel products. From 2014 to 2019, 12 companies and investment firms from China poured billions of dollars of investment into Indonesia’s nickel mining sector. Nickel mining in Indonesia has surged and now supplies more than 40% of global nickel demand. The sharp increase in supply has led to a collapse in nickel prices and forced mine closures in other parts of the world. The experts are concerned that China can control certain minerals markets and kill prospective projects in the West by changing their metal supply.

According to the CEO of a mining processing company we interviewed, “The mining companies capture most of the value, not the downstream mineral processing companies. Companies that are vertically integrated are the ones capturing the most value. Our ultimate goal is to go upstream to mining.” Since China owns most of the processing across all critical minerals, expanding upstream into mining extraction makes economic sense.

Demand side

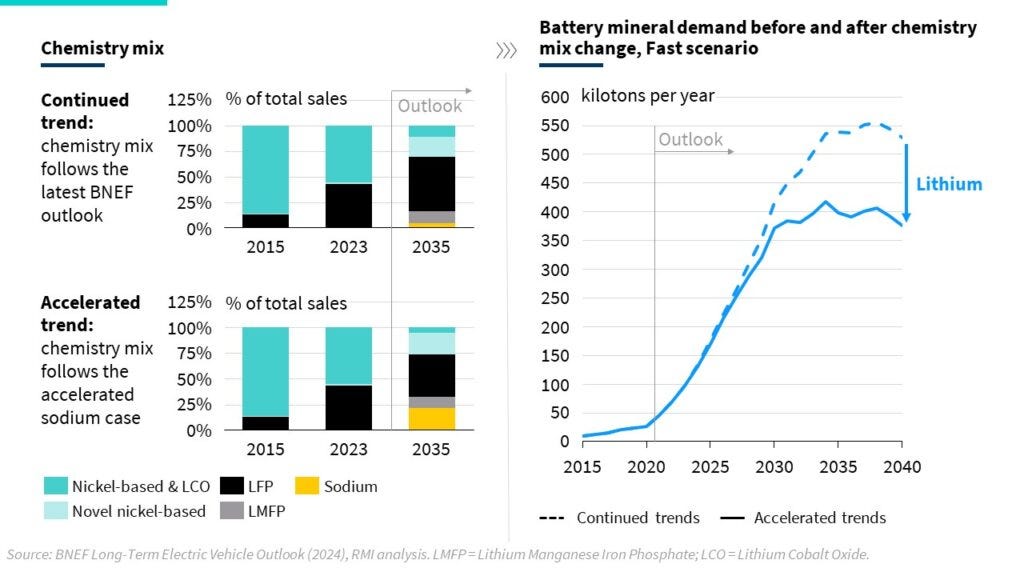

#1 An incremental shift away from lithium batteries can bend the demand curve

A range of novel battery chemistries are being developed by startups today that shift away from using lithium, cobalt, and nickel. Sodium batteries are nascent but have the potential to power grid storage and micro-mobility which don’t require as high energy density as cars or trucks. If it can ramp up in the next decade, lithium demand can stabilize. However, startups will struggle to sell their batteries with a green premium. In our next article, we will map out the battery value chain so you can understand the challenges and opportunities.

#2 EVs continue to shift away from rare earth element (REE) motors and adopt more copper-rich motors

In 2023, Tesla, which has ~50% market share in EVs, announced that their newer models will no longer use rare earth minerals. Other EV OEMs such as BMW, Renault, and Audi have announced the same. This transition will increase the demand for copper, and reduce the reliance on rare earth minerals.

#3 The uptake of climate tech slows or accelerates

The International Energy Agency (IEA) projects that demand for critical minerals will increase rapidly, but the extent of the increase hinges on the adoption of climate technology to meet Net Zero goals. The IEA estimates that the demand for critical minerals will double or triple by 2030 based on pledges made. However, many of these pledges have fallen short. An increase of 10% in emissions is expected by 2030 rather than the 45% reduction of emissions pledged.

#4 Battery recycling technology takes off

Battery recycling can eliminate further mining by an estimated 10 TWh/year over several decades. An analogous proof of concept is that 99% of battery lead is already recycled. In almost every US state, you can’t buy a lead-acid automotive battery without turning in your old one, and lead is now rarely mined. In our upcoming series, we will dive deeper into the types of battery recycling technologies and trade offs between them.

Bottom line

Critical minerals are the bedrock of the clean energy transition, but they’re mired with extreme price volatility, international politics, and regulation. Demand can double or triple (or stay the same) depending on climate tech adoption and technological breakthroughs.

As startups rush to take advantage of this opportunity, they must overcome challenges in scaling in a consolidated, volatile industry. When prices are high, the appetite to pay more for innovative technologies increases. When prices crash, players pull back and startups must compete against a much cheaper alternative. Startups have to survive in a global landscape where monopolistic companies - and even countries - pull strings and move markets.

Stay tuned as we discuss the battery value chain and battery recycling next.