During Third Sphere’s NYCW event on exits in climate technology, the team leaned on secondary market trading activity to anticipate what the next climate tech IPO would be. Out of the top 50 startups being traded in Hive, there were a handful of climate companies. One of them is Redwood Materials… a battery materials recovery company. Since receiving its first check in 2017, Redwood Materials has raised $3.8B in total funding, half of it coming from a $2B Department of Energy loan. In August 2023, it raised a $1B Series D at a $5B valuation. 🦄

I’ve been curious about battery recycling ever since. Today’s article will focus on the value chain of battery recycling (and where Redwood Material sits), the tradeoffs between emerging battery material recovery technologies, and bull/bear cases of the future. The insights from this article are drawn from Yutong Zhu and Yuelang Chen’s ~70 interviews during Stanford’s Climate Ventures course with experts, operators, and investors in this space.

⭐ Want to learn how your business background is valuable for climate technology companies? Lisa Wang, an early employee and member of the commercial team for Antora Energy which is close to unicorn status, has offered to be part of an AMA (“Ask Me Anything” Session). Antora Energy is hiring for business roles from analyst to Director and is hoping to close on candidates by the end of this year. Comment on this chat thread here by the end of this week what your questions are, and we will post the answers to the top ten questions asked. ⭐

The Value Chain of Battery Recycling

Redwood Materials is part of the battery materials recovery step that has the greatest profit potential

While the battery materials recovery step has the greatest profit-generating potential, it relies on the prior steps working at scale and in lockstep. The reality is not close to the potential… yet.

Here are the main challenges we heard in the North American market:

Supply: Not enough EV batteries

While EV adoption is continuing, it’s slowing. An expert said that there is competition for scrap material, and battery recycling is relying on manufacturing scrap, not end-of-life batteries. EVs from developed countries are not recycled but rather sold to developing countries where the battery recycling infrastructure is even more nascent. Old EV batteries are also being repurposed into stationary energy storage like Moment Energy, increasing competition for EV batteries even more.

Transport and storage: No battery passport

In the United States, without a battery passport specifying the battery details across its lifecycle, it is hard to tell the components and history of an end-of-life EV battery if you are not the cell manufacturer. As a result, regulators treat used batteries as hazardous materials and hazardous waste regardless of a battery’s state of health, adding cost to the battery storage and transportation process which can be 40-60% of a battery recycling costs. There’s a suite of specialized technologies like gamma rays to identify the battery’s internal composition, but they are expensive and require specialized expertise.

Shredding and black mass production: Volatile price fluctuations for black mass

Once the battery is shredded and crushed into a material called black mass, it can be sold to a materials recovery player like Redwood Materials to recover the critical minerals. The price of black mass is volatile because it’s tied to price fluctuations of its valuable minerals and different battery chemistries produce different compositions of black mass. As a battery recycler, having volatile cost drivers can make it difficult to run a profitable business.

Customers: Margin squeezing

If the end customer is your supplier, your margin can be squeezed on both ends. Vertical integration becomes an important strategy to protect margins with new emerging business models:

Single player vertical integration: Redwood Materials has made major moves to put all these steps under one roof. They collect batteries, process, shred, and recover the valuable materials in their facility, and remanufacture the materials into battery components.

Value chain partnerships: Recyclers have also struck cross-value chain partnerships where specialized players across these steps operate together under a partnership agreement to deliver an end-to-end solution. Heritage Battery Recycling, Retriev Technologies, and Battery Solutions formed a combined entity.

In-house OEM: OEMs have also launched their own internal recycling units, sidestepping this value chain. Tesla, Audi, and Volkswagon have started piloting their own units, and others have outsourced their recycling with a battery recycling company through a partnership.

Going upstream: Mining companies like Glencore and Rio Tinto have started to sign deals for critical minerals recycling to expand their sustainability strategy.

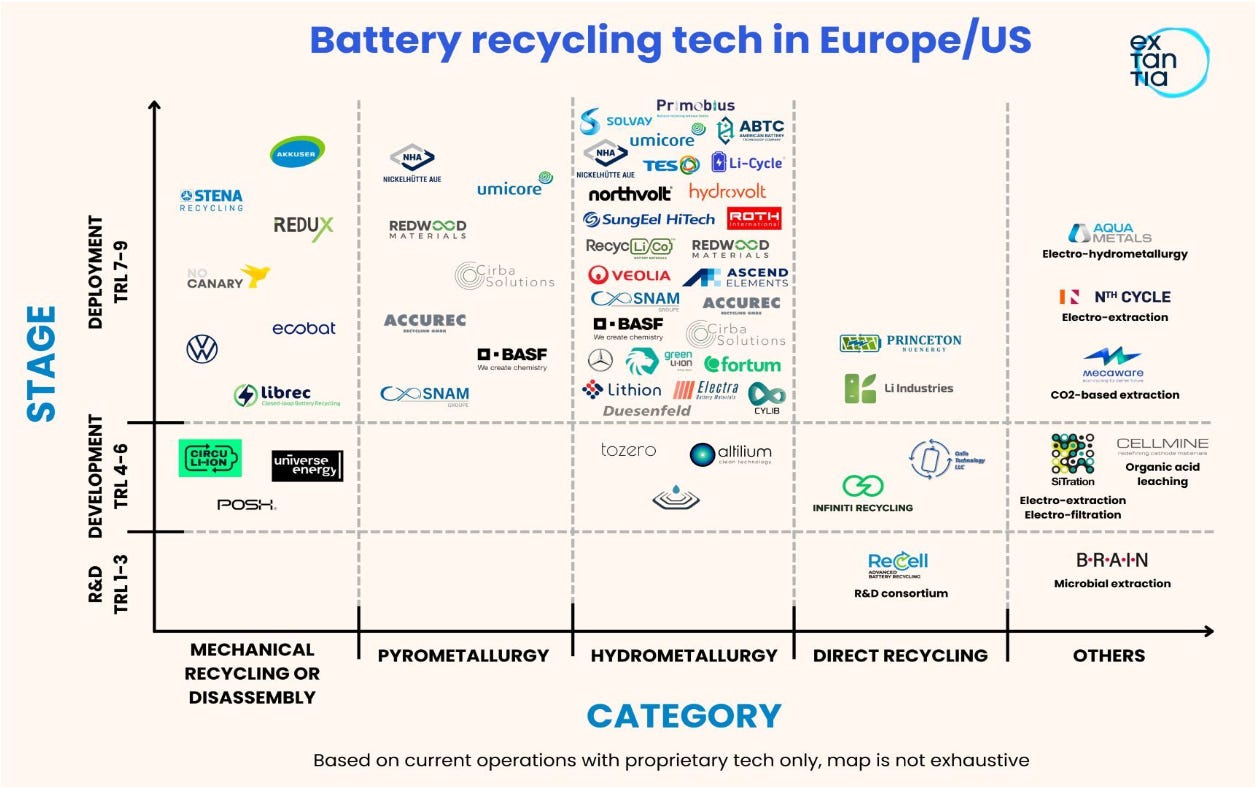

The Landscape of Battery Recycling Technologies

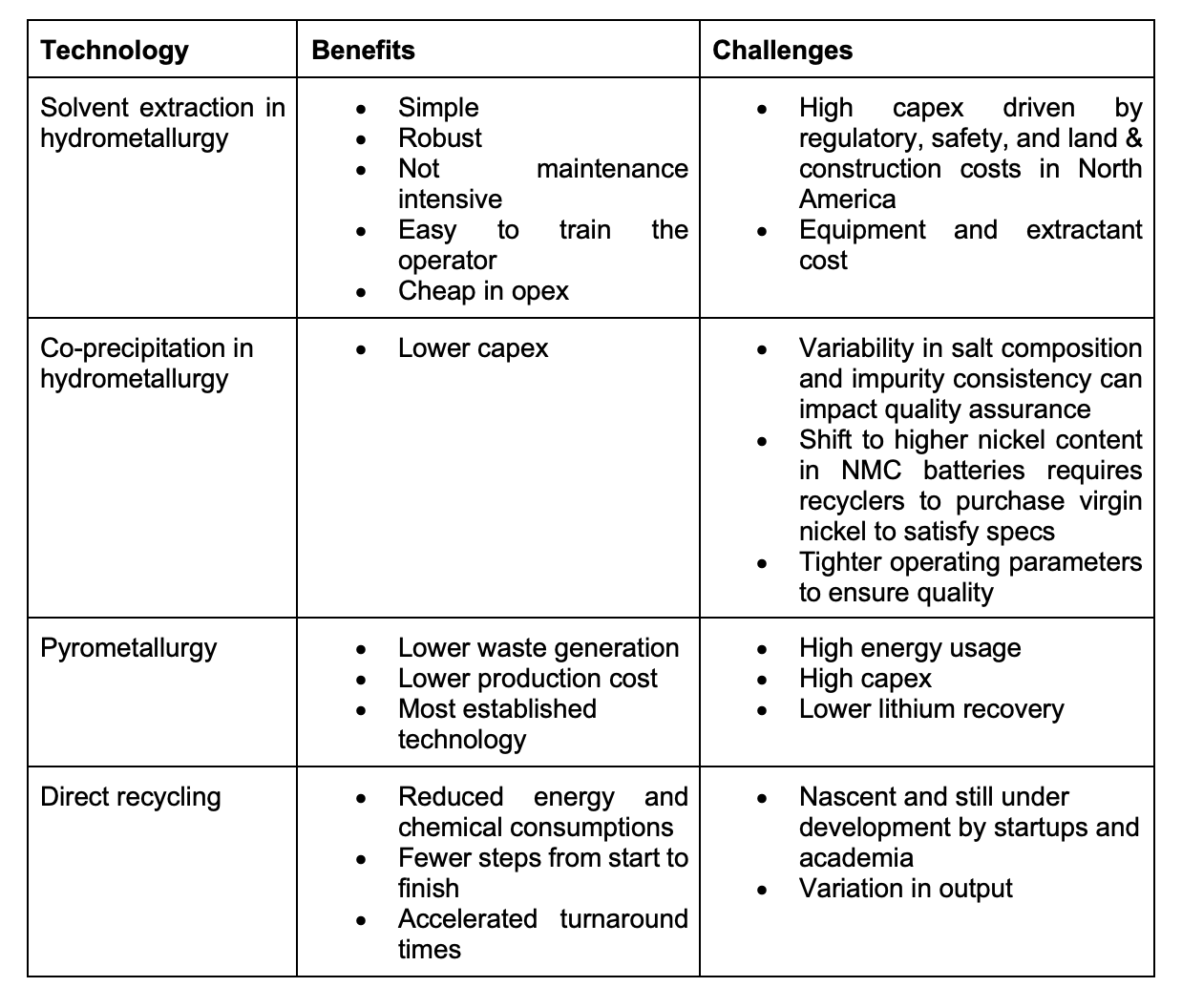

Pyrometallurgy

Pyrometallurgy is the process where metals are smelted to recover valuable materials. This is considered to be the first generation of battery material recovery technologies. It is often used in conjunction with hydrometallurgy (more below).

Hydrometallurgy: Solvent Extraction versus Co-precipitation

Hydrometallurgy takes the black mass and treats it with acid until the metals are dissolved. Startups are innovating different ways of taking the dissolved metals and separating them into the metal ions (“Salts”) used for battery ready materials.

The solvent extraction method is well established in mineral processing and has been adopted for battery material recovery in Asia.

The co-precipitation method attempts to extract the salts with fewer capital-intensive steps, but the removal of impurities is challenging and a source of innovation. The output of mixed salts often needs to be adjusted by adding more nickel to it before it can be sold, increasing costs.

Direct recycling

Direct recycling is dramatically different than the approaches above. Direct recycling focuses on recovering valuable materials without breaking down black mass. Instead, players mechanically separate materials and use proprietary methods to restore the elements to their original performance.

Bull Case

EV adoption accelerates with IRA subsidies in the US

Learning gains dramatically reduce costs in the United States like they have in China (the cost there is 20-30% of the cost in the US)

Economics for virgin and recycled batteries become the same

Battery passport is rolled out in the United States like in Europe which helps identify valuable EOL batteries

Challenges in the nascent value chain get ironed out over time and become more efficient

The IRA clause that allows recycled battery materials (for example, lithium, cobalt, and nickel) to qualify for significant tax credits available through the domestic materials clause continues to drive adoption

Bear Case

EV adoption continues to slow down, reducing the supply of EV batteries

Reusing and repurposing batteries becomes harder and harder as batteries improve (ex. Encapsulation of batteries in polyurethane foam and cell-to-chassis)

Battery prices continue to drop, reducing the economic need to reuse

The IRA clause is removed by the new administration

Battery passport is not rolled out and transportation/storage continues to drive up cost

Bottom line

Battery recycling plays are for the long game. While the battery material recovery step has the highest profit potential, players reckon with a nascent supply chain that struggles with price volatility, supply constraints, costly logistics, and margin squeezing. The response is to vertically integrate - a tall order and expensive endeavor. Will it be worth it? We will see when and if Redwood Materials IPOs and I will be eagerly reviewing its financials.

There's a company called NEU Battery Materials that's doing something really cool in this space!

Awesome post, I've definitely been interested in the question around climate exits as the peak of startup creation was around 2020. As for the batteries, I wonder how hybrid vehicle adoption has been recently and how that plays a role in this story!